managed fund vs etf

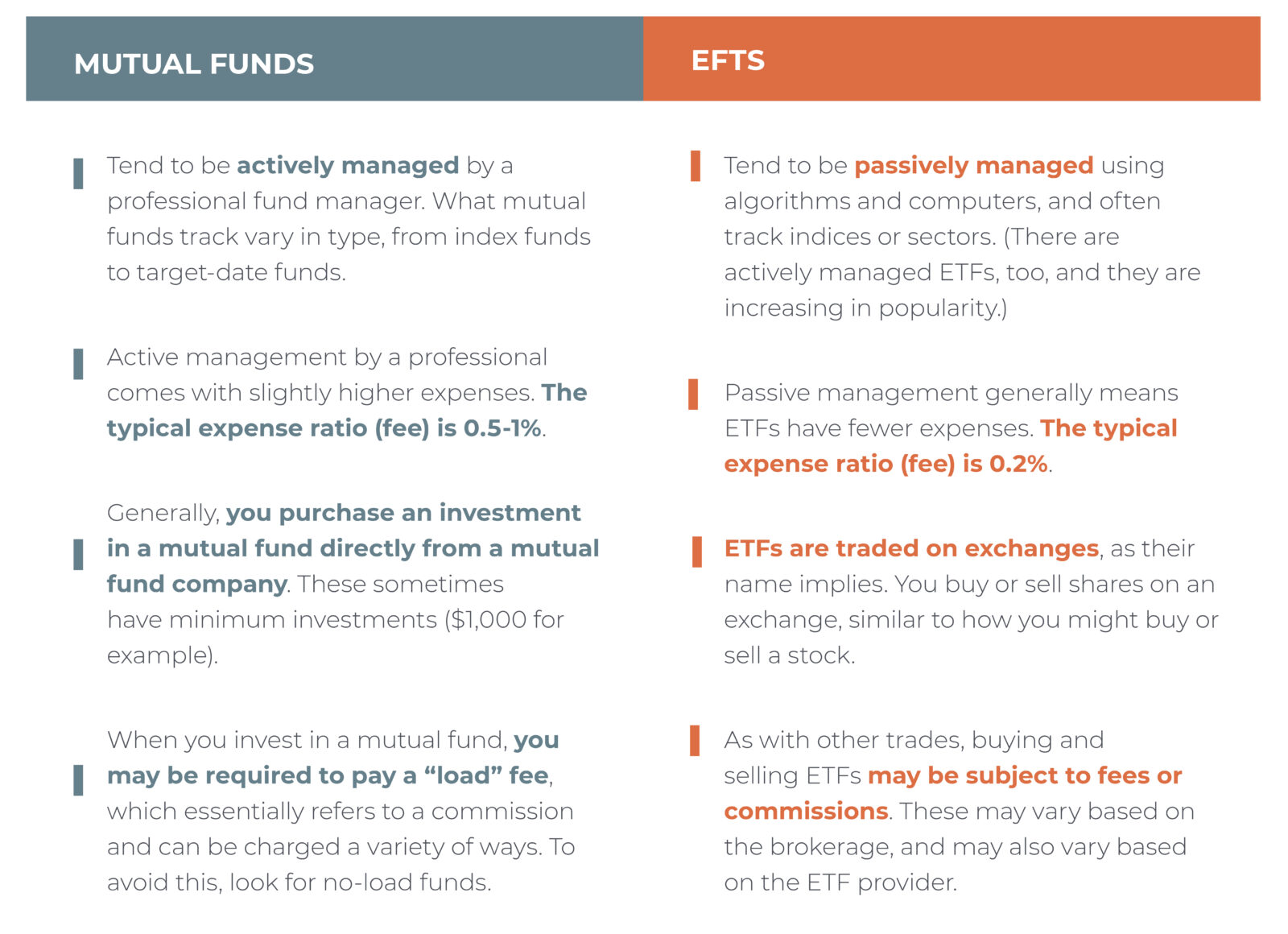

Compare the funds performance to index funds that invest in the same asset class or similar. Unlike investing in individual shares or ETFs a managed fund is managed.

|

| Index Funds Vs Mutual Funds The Main Differences |

ETFs and managed funds are both managed by professional fund managers.

. The total number of super accounts is quite telling given that Australias population is currently just under 26 million. They choose and monitor the holdings the funds invest in. Another major difference between active ETFs and actively-managed mutual funds relates to transparency. ETFs offer a far greater degree of transparency than managed funds.

ETFs are simply listed versions of managed funds. According to the ATO over 12 million Australians have one super fund. Just like their passive counterparts most active ETFs publish their. Generally speaking a managed fund is only required to report on its holdings to shareholders on a.

Both ETFs and managed funds have in-built. Index funds are a type of mutual fund or exchange-traded fund ETF that mirror the performance of a specific stock market index. In the broadest sense exchange-traded funds ETFs can be. ETFs and managed funds are both managed by professional fund managers.

The portfolio manager of an actively-managed fund tries to beat the market by picking and choosing investments. The key difference between ETF and managed fund is that ETF is an investment fund usually designed to track an index a commodity or bonds where the value of the fund. The Investment Company Institutes latest survey of expense ratios looked at the average expense ratios of actively managed equity mutual funds versus index equity funds. Instead of purchasing directly through the fund management company you buy a share of the fund on the stock exchange.

Managed funds are good for investors who wish to incrementally add savings to investment because regular contributions are permitted though accumulating a significant. But managed funds also have their disadvantages. Both ETFs and managed funds have in. Compare managed funds and look at.

Key Takeaways Mutual funds are pooled investment vehicles managed by a money. The first one to consider is the cost. Whereas an ETF that tracks an index of 150 global. They choose and monitor the holdings the funds invest in.

How are actively managed funds supposed to do. The universe of managed funds is huge and deciding where to place your assets can be as tricky as choosing single shares. The long-term performance for example 5 to 10 years. With the entire investments of the fund in the stocks of a particular category the performance of an ETF directly depends on the performance of the benchmark index.

For example a managed fund that offers investors exposure to companies around the world has a management fee of 135 pa. Online brokers are plentiful and they do offer low rates. ETFs are bought and sold like shares so you need a sharemarket account and a broker. A managed fund is bought from the fund.

A stock market index measures a particular. While similar in many ways here we discuss the differences between an index fund vs.

|

| High Cost Index Funds And Low Cost Actively Managed Funds My Money Blog |

|

| Etfs Vs Mutual Funds What S The Difference Investing Com |

|

| Etf Vs Mutual Fund What S The Difference Ramsey |

|

| What Is An Active Etf And What Are The Benefits For Investors Chris Meyer Livewire |

|

| Etfs Vs Actively Managed Mutual Funds And The Popularity Of Index Investing Seeking Alpha |

Posting Komentar untuk "managed fund vs etf"